A checking account is a deposit account provided by financial institutions for the purpose of creating a safe and secure way to transact your money. It is also referred to as a transactional account or demand account. It is very liquid and provides a convenient way of going about your daily financial needs. Over the years, a lot of financial institutions have popped up. Not knowing which one will favor your every need can be pretty frustrating.

That’s why we have developed this review. After analyzing a lot of financial institutions that offer checking account services, we have narrowed our findings to six. We promise these top six checking account providers are worth your time and attention to evaluate. Let’s explore.

SoFi Checking and Savings

Topping our list at number one is SoFi Checking and Savings. If you are searching for an all-rounded checking account, SoFi will not let you down. It offers interesting perks and reliable features, including:

- Cashback

- High-yield interests on your balances

- Cash bonuses

SoFi pays up to 0.50% APY on monthly checking balances and 4.60% on savings balances. This is possible if you set up a direct deposit or choose to deposit a minimum of $5000 monthly.

Further, you can earn up to 15% cash back when using SoFi debit card services. This is, of course, at selected retailers. To identify some of the retailers that qualify for this, you can participate in their cash-back program via the banks’s app.

It’s good to note that in order to enjoy all the perks under this bank, it’s best to set up a direct deposit or ensure you make at least a $5000 monthly deposit to your account. This way, you’ll qualify for better rates and even stand a chance to qualify for a $250 cash bonus.

In this ever-changing world, anything can happen; the economy can drop drastically, or you can fall sick and need medical attention. Due to this, savings accounts are essential if you want to achieve financial health and stability. These accounts provide secure locations to put and grow your money. Additionally, you can accumulate the funds for long-term purchases or unforeseen emergency expenses. Here are some of the benefits of having a savings account:

- Financial safety: Having savings accounts from federally trusted banks will offer you secure savings accounts.

- Liquidity: Savings accounts also lead to liquidity. They will enable you to access your funds while keeping them away from other expenditures.

- Financial goals: Savings accounts will be a practical option if you want to have a successful financial plan. You will be able to set aside money for unforeseen expenses.

- Earn interests: A savings account differs from other checking accounts since your cash yields interest over time.

Even though savings accounts will benefit you, there are some setbacks you need to be aware of before opening an account. Some of them include:

- Policy concerning the minimum balance: Certain banks limit the money you can keep in your account.

- Restrictions regarding access: some financial institutions can restrict the amount of money you can withdraw each month.

- Low profits from the interest rates: savings accounts have comparatively low interest rates compared to other investments. It can take a long time to yield high interest.

Capital One 360 Checking

Capital One 360 is a renowned national bank offering some of the most well-rounded checking accounts in the country. Here’s the best part about this checking account: you require a $0 minimum opening deposit, no overdraft fee, no monthly service fee, and no foreign transaction fees. In addition, the Capital One checking account offers numerous overdraft options to choose from, making it stand out among others. An example of an overdraft offered is a free savings transfer. For this to be effective, you must link your savings account to your checking account.

If you overdraw, the bank automatically transfers money from your savings account, covering your overdraft. The best part is all this is done absolutely for free. This is a bonus for Capital One, considering most financial institutions charge a fee. Capital One has various Cafes spread around selected parts of the country. Here, you can get access to your banking services. They also offer online banking, which you are always advised to get well-versed in.

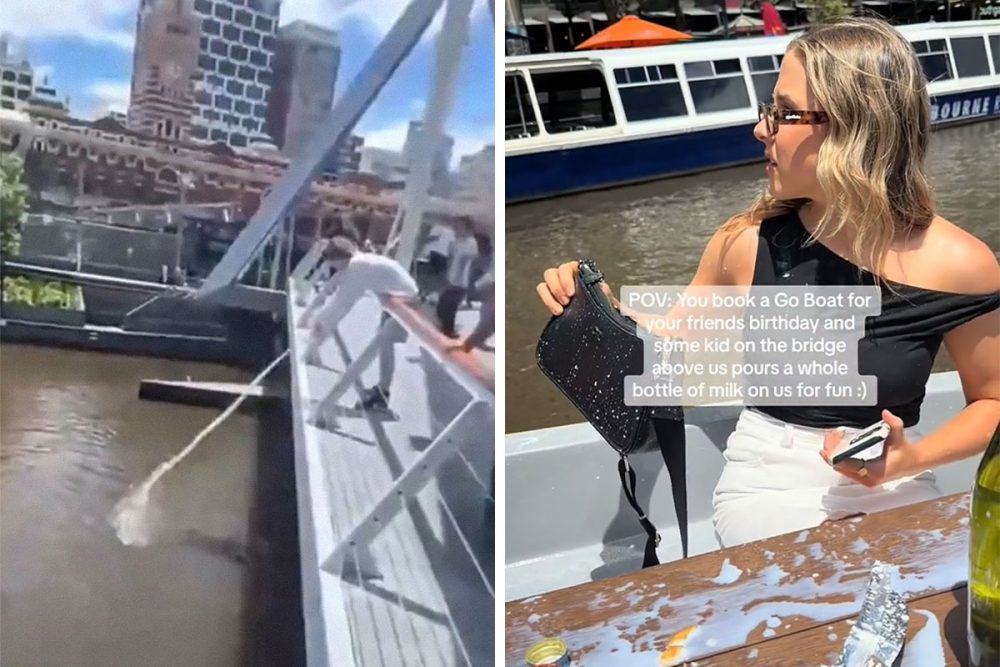

Redneck Bank Rewards Checking Account

Redneck Bank Rewards Checking Account is widely famous for their appealing rewards and interest rates. When you open a checking account with them, you can earn a bonus rate of 5.30% APY on account balances up to $15,000.

In addition, you can also earn yourself a 0.50% APY if your balance is above $15000. When it comes to earning higher interest rates on your balances, you must ensure you make at least ten successful debit card transactions monthly.

Once you have achieved the monthly requirements, Redneck Bank Checking offers you a 0.25%APY. To open a checking account with Redneck Bank, you will be required to make a minimum deposit of $500.

Chime Checking Account

Another checking account to consider in 2024 is the Chime Checking Account. It is straightforward regarding the account activation requirements and is best for beginners. Further, a Chime Checking Account might interest you if you've experienced a bad banking history. This is because this bank does not require a credit background check or review by ChexSystems.

It may also be useful if you want to avoid common bank fees. This is because the online banking platform does not charge foreign transaction fees, overdraft fees, or monthly service fees. However, there are some limitations surrounding Chime’s SpotMe feature. The account only allows overdrawing by up to $200. In order to qualify for this perk, you must receive a minimum of $200 monthly in direct deposit. You cannot make an overdraw of more than $200. This transaction will not be processed and will automatically be denied.

Upgrade Rewards Checking Plus

Upgrade Rewards Checking Plus is a great choice if you're searching for a rewards checking account with cash-back benefits. With Upgrade Rewards Checking Plus, you can get 2% cash back on regular debit card payments, including those made at petrol stations, restaurants, pharmacies, convenience stores, and bars, as well as utility and monthly subscription payments. You can also receive 1% cash back for any additional debit card purchases.

In addition, the annual cap on the 2% cash-back benefit is $500. Once you've reached the annual maximum, you'll receive 1% cash back on all eligible purchases for the rest of the year. To maximize the benefits of the Upgrade Rewards Checking Plus Account — such as loan discounts and ATM fee reimbursements — receive at least $1,000 in direct deposits per month. Otherwise, you will not be eligible for these benefits.

It's good to note that some transactions do not qualify for cash-back benefits. For instance, you will not benefit from purchases made with gift cards, refunds, money orders, foreign currency, ATM transactions, money transfers, or fraudulent charges.

Schwab Bank High Yield Investor Checking Account

If you want to open a checking account with a well-known company, the Schwab Bank High Yield Investor Checking Account is an excellent alternative. This account is especially appealing if you currently have a brokerage account with Charles Schwab. The best thing about this account is its ATM benefits. When an ATM provider imposes a fee, Charles Schwab offers unlimited refunds globally and doesn't charge ATMs. This is a great bonus for all your checking account needs.

Common Checking Account Fees

Checking accounts frequently have fees, much like the majority of financial goods. Here are the top two (along with advice on how to prevent them):

Monthly service fee

A lot of checking accounts, particularly those from large banks, have up to $15 in maintenance costs each month. If you satisfy certain conditions, such keeping a minimum amount or setting up direct deposit, you could be eligible to have the monthly charge waived. Additionally, there exist checking accounts with no monthly fees known as no-fee accounts.

Overdraft fee

You can be charged a high overdraft fee, usually $30, if you spend more than what is available in your account. Enrolling in overdraft protection, which rejects transactions larger than the amount in your checking account or transfers excess money from a linked savings account, can help you prevent this.

How to Open a Checking Account

Once you've selected it, opening a checking account is relatively easy. You can visit a nearby branch or register online. You will be required to submit personal data, including your social security number, name, address, and birthdate.

The bank could occasionally perform a credit check, but it will probably be a light draw that doesn't negatively impact your credit. To ensure this, you should review the terms again before creating an account.

To start your account, you need to make a deposit, which can be made online, with a check, or with cash, depending on the bank. This might be as little as $1 or as much as $50.

Additionally, you want to confirm whether the checking account is protected by the National Credit Union Administration (NCUA) or the Federal Deposit Insurance Corporation (FDIC). A basic insurance sum of $250,000 is offered by the FDIC and NCUA to each depositor, bank, or credit union. If your bank or credit union collapses, this insurance covers you and reimburses you up to your balance and the maximum amount allowed by law.

Key Takeaway

Doing deeper research on other aspects, such as the availability of the financial institution in your area, is also key to settling for the best bank. After setting up your checking account with the financial institution of your choice, you may want to configure some of your account features to help you manage your funds more easily.

Signing up for direct deposit and online payments and scheduling automatic transfers to your savings account will help you build your emergency fund. These and other advantages will make you glad you discovered a spot to park and spend your money. At Online Finance, we make sure to keep you updated on all things finance. Check us out for free to learn more about other financial products that can give you the financial freedom you need on your way to 2024.

Find here the best online checking accounts for 2024

Frequently Asked Questions (FAQs)

What Are the Different Types of Checking Accounts?

Regular checking accounts, premium checking accounts, interest-bearing accounts, senior checking accounts, student checking accounts, business checking accounts, and rewards checking accounts are among the several checking accounts.

Does closing a checking account hurt my credit?

Since bank accounts are not reported to consumer credit bureaus, closing a checking account often has no impact on your credit. However, completing a checking account with unpaid fees or ongoing overdrafts may result in a bad comment on your ChexSystems report.

What is a checking account used for?

All-purpose venues to hold money for immediate to medium-term financial requirements are checking accounts. You can pay bills with it, make wire transfers, deposit checks from your phone, and link it to payment apps like Venmo and PayPal. Your employer can deposit paychecks straight into the account. A checking account is the foundation for managing your finances and streamlining financial duties.